The Cooper/Eromanga Basins are the premier onshore oil and gas producing basins in Australia. The Cooper Basin is a Permo-Carboniferous to Triassic basin with sediment up to 2,500 metres thick which consists of interbedded sandstones, shales and coals. The overlying Eromanga Basin is Early Jurassic to Late Cretaceous in age and has sediment up to 3,000 metres thick which consist of sandstones, siltstones and shales.

Over 2,500 exploration and development wells have been drilled in the Cooper/Eromanga Basins to date with estimated cumulative production of over 6.2 Tcf of gas, 315 MMbbl of oil and 92 MMboe of condensate.

The Cooper/Eromanga Basins are connected to the Adelaide and east coast markets via gas pipelines, with oil and liquids pipelines connecting the region to Port Bonython in South Australia and Moonie/Brisbane in Queensland.

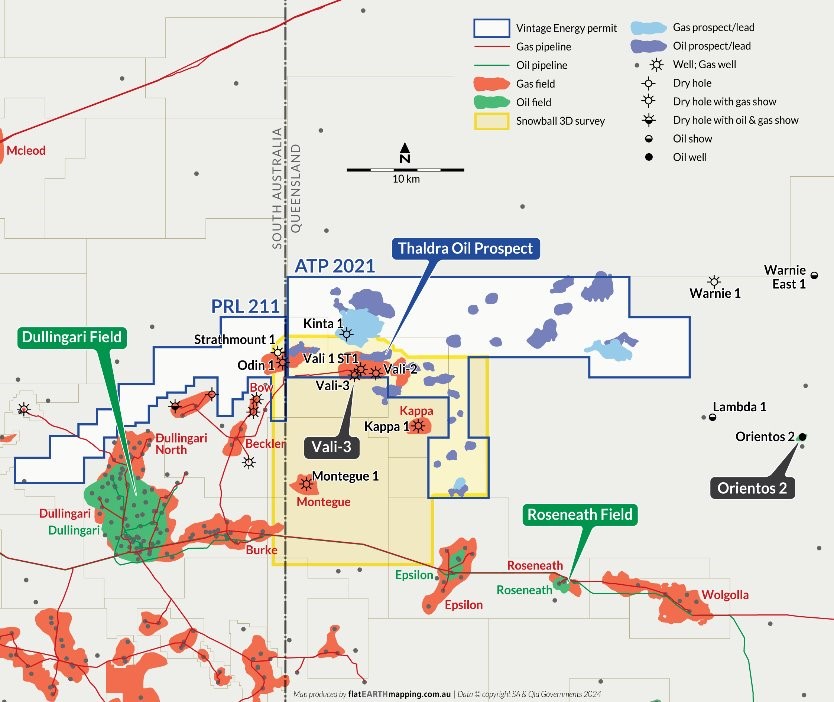

In the southern flank of the Nappamerri Trough, Vintage Energy is Operator and 50% interest-holder in two neighbouring permits: ATP 2021 in Queensland and PRL 211. The permits are held by separate joint ventures with identical composition.

ATP 2021 is located in Queensland, adjacent to the Queensland-South Australia border. The permit contains the Vali gas field and the eastern flank of the Odin gas field. Both fields were discovered by Vintage in drilling following its farmin to ATP 2021 and PRL 211 in 2019.

Vali was discovered by Vali-1 ST1 in January 2020 and successfully appraised by Vali-2 and Vali-3. Reserves at Vali have been independently certified and most recently reported in the 2024 Annual Report as comprising gross Proved and Probable sales gas and ethane reserves

The field has three wells completed and connected to the Moomba gas gathering network for supply to the eastern Australian domestic energy market via the Vali-Beckler pipeline. Vali is currently subject to a long-term production appraisal program with gas produced being supplied to AGL Energy under a supply agreement to December 2026.

Production appraisal has been underway from Vali-1 since February 2023. Gas production is yet to be established from Vali-2 and Vali 3 which is shut-in pending resolution of fluid production issues.

In June 2023 Odin-2 successfully appraised the eastern extent of the Odin gas field in ATP 2021. Odin-2 was brought online October 2024.

Vintage has on behalf of the ATP 2021 joint venture, applied for a Production Licence (PL1125) over the Vali gas field. As part of the process an application has been submitted for an Environmental Authority (EA). The EA application documents can be viewed here.

Vali gas field Underground Water Impact Report (UWIR)

Copies of the approved report may be obtained by contacting info@vintageenergy.com.au

PRL 211 lies in the South Australian Cooper Basin, with the licence’s eastern boundary near the western boundary of ATP 2021. The licence is in close proximity to the South Australian Cooper Basin’s Joint Venture’s gas production infrastructure at Beckler, Bow and Dullingari.

The licence holds the western portion of the Odin gas field, which was discovered by the PRL 211 joint venture in 2021 and commenced appraisal production from Odin-1 in September 2023. Odin-1 was completed to produce initially from the Epsilon and Toolachee formations, with production from the Patchawarra Formation to be added in the September quarter 2024. Gas produced from Odin is supplied to Pelican Point Power (a joint venture of ENGIE and Mitsui Australia) under agreements extending to December 2026.

The southern flank permits are prospective for additional gas and oil discoveries. The has is a proven oil producing region with Santos operated fields such as Dullingari (which has produced approximately 11 million barrels of oil), Roseneath and oil recoveries such as Orientos-2.

Vali-3 recorded good oil shows with associated background gas despite a lack of closure at the Jurassic/Cretaceous level. Over 20 closures have been identified in ATP 2021 and a prospect, Thaldra-1, has been identified on 3D seismic is drill-ready and is economically attractive.

Vintage 100% subject to land title agreement, reducing to 50% on farm-out agreement execution

PELA 679 is a petroleum exploration licence application in the south-west of the South Australian Cooper Basin, for which Vintage Energy is the successful bidder. The licence is situated south-west of the Worrior oil field which has produced in excess of 4.5 million barrels of oil. Comprising a total area of 393 km2, the permit is considered to hold Permian and Jurassic oil potential.

Award of PEL 679 to Vintage is contingent on establishment of an appropriate land access agreement, negotiations for which continued during the year.

Vintage has entered into a farmout agreement with Sabre Energy Pty Ltd (“Sabre”) to farm-out 50% interest in the South Australian Cooper Basin exploration licence PEL 679, subject to granting. Vintage will retain operatorship and a 50% interest in the licence following completion of the farmout.

Sabre will fund 100% of a 150 km2 3D seismic survey and pay Vintage $200,000 as reimbursement of its share of costs incurred to the time the permit is granted.

Completion of the farmout work will satisfy the Year 1 work program for the permit and is expected to provide the data for more accurate mapping of potential drilling candidates.

The farmout agreement is subject to a number of conditions precedent including, but not limited to, regulatory approval, receipt of necessary consents and authorisations.