Vintage Energy Ltd (ASX: VEN, “Vintage”) is pleased to advise that it was well oversubscribed with its $2.25 million share placement to institutional and sophisticated/professional investors (“Placement”) at an issue price of $0.036. A Share Purchase Plan (“SPP”) will also be undertaken through the issue of new fully paid ordinary shares at $0.036 per share, in line with the Placement, and will target gross proceeds of up to $0.75 million. Directors and Management of Vintage have committed $667,000 toward the Placement and SPP, with shareholder approval at an EGM (scheduled late May / early June) to approve the commitment of funds by the Directors in the Placement (totalling $385,000).

The funds received from the placement and SPP will be used for:

Vintage’s Managing Director, Neil Gibbins said, “It was pleasing to see strong demand for our $2.25 million placement to institutional and sophisticated/professional investors. All shareholders now have the opportunity to acquire shares at the same price as the placement through a Share Purchase Plan, targeting up to $0.75 million. The funds raised will primarily be used for the upcoming stimulation and flow test work at our Vali discovery.

We initially raised money via our IPO in September 2018 to make discoveries for future commercialisation and have done so, close to facilities and market. Vintage will focus on the Vali Field and pursue a quick turnaround on activities to commercialise this exciting new discovery. The Australian east coast market still requires gas and Vintage is determined to contribute in a meaningful way to Australia’s requirements and generate future returns for shareholders in these difficult times.”

Covid-19 response

The Board and Management would like to assure all shareholders that it is doing everything within its control to respond to COVID-19 and the guidelines and information being provided by the Federal, State and Territory governments. Actions taken to date are aimed at ensuring the safety and well-being of our employees and contractors, as well as support the long-term viability of the business. To this end, the Vintage office has been closed temporarily and all staff are currently working remotely to ensure the safety and well-being of not just themselves but the community as a whole.

Steps have also been taken to reduce administration costs and consultancy fees to preserve the Company’s cash balance, with the deferral of discretionary exploration projects now in force. These are prudent steps in these uncertain times, however, at the same time we must seek to position the Company for growth once we emerge from the current crisis.

Regarding appraisal of our two recent discoveries, site operations have been prioritised to well bore evaluation activities essential to ensuring an efficient and safe fracture stimulation followed by flow testing of the Vali discovery. Pressure testing of the Vali-1 ST1 wellbore was successfully undertaken last week, demonstrating both wellbore integrity to design specifications and the ability of the Company to undertake work across state borders with appropriate COVID-19 processes and protocols in place. A cement bond log will also be acquired to assist with fracture stimulation planning. The desktop planning for flow testing for both the Vali gas discovery and the Nangwarry CO2 discovery is already underway.

Capital raising terms

Vintage is seeking to raise up to a maximum of $3.0 million through the combination of a Placement and an SPP by issuing new fully paid ordinary shares at $0.036 per share. Committed shares in the Placement have been placed with institutions and sophisticated/professional investors (who qualify under s.708(8) to (12)). As mentioned previously, Directors and Management of Vintage have committed to subscribe for $667,000 of the Placement / SPP, with the Director’s commitment of $385,000 in the Placement subject to shareholder approval.

Placement

The Placement was conducted using a single tranche structure in accordance with the Company’s available placement capacity pursuant to ASX Listing Rules 7.1 and 7.1A, with the component to be subscribed to by Directors and Management to be approved by shareholders at an EGM to be conducted in late May / early June 2020. The Placement will comprise 62.5 million shares at a price of $0.036 per share for a total of $2.25 million.

The Placement price of $0.036 per share represents a discount of 10% to the Company’s last closing price of $0.04 on 27 April 2020 and an 15.4% discount to the 5-day VWAP. Settlement of the Placement is expected to occur on 6 May 2020, with Placement shares expected to be allotted (pursuant to Listing Rules 7.1 and 7.1A) and to commence trading on 7 May 2020. An Appendix 3B confirming the exact allotments will be issued on the same date.

SPP

Vintage is also offering existing eligible shareholders the opportunity to participate in an SPP to raise up to $0.75 million at the same issue price as the Placement, being $0.036 per share. Eligible shareholders recorded on the register at 5:00 pm (Adelaide time) on 29 April 2020, will be entitled to apply for shares at $0.036 per share for a minimum investment of $2,500 and maximum investment of $30,000, free of brokerage and other related transaction costs.

Participation in the SPP is entirely optional and is open to all shareholders, other than shareholders who have registered addresses in countries outside Australia where regulatory requirements make participation by the shareholder unlawful or impracticable.

The Company will apply for quotation of the new shares issued under the Placement and SPP on the ASX, which will rank equally in all respects with existing Vintage fully paid ordinary shares.

Vintage may, in its absolute discretion, allocate less than the number of shares applied for in the SPP and determine to apply the scale back to the extent and in the manner that it sees fit. Any unallocated funds will be returned to applicants without interest in this case.

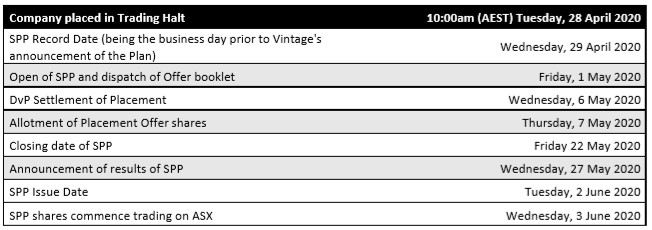

Capital raising timetable

Investor Presentation

Further details of the Capital Raising are detailed in the investor presentation released on the ASX platform today.

The Vali discovery

In Australia’s energy market operator’s (“AEMO”) annual Gas Statement of Opportunities report for 2020, AEMO warned that pipeline capacity and maturing gas fields could pose a significant risk unless further action is taken to ensure energy security. AEMO states that after 2025 existing and committed gas production and projects in southern Australia would not be enough to meet east coast demand. This report is further vindication of Vintage’s strategic goal of delivering gas into the east coast gas market, with the Vali discovery on the verge of achieving this goal.

Our position as a gas focused exploration and appraisal company is also supported by both Federal and State Governments, who have stated that the oil and gas industry is an ‘essential service’. This is an important position for the government to take and will assist Vintage in its near-term aspiration of producing gas for the east coast market within the next twelve months.

As a result of the above, the testing of the Vali gas discovery and its potential for timely commercialisation and sale of gas into the east coast gas market is a key priority for the Company. Funds from the capital raise will be used to carry out the fracture stimulation and flow testing of the Vali-1 ST1 well and to undertake initial engineering and design work to estimate costs to connect Vali-1 ST1 to the Moomba gas flowline network. Once Vintage completes a successful flow test of the Vali discovery, funding options beyond a capital raising, including, but not limited to, the pre-sale of gas, tolling arrangements in exchange for connection infrastructure and the introduction of new partners will be investigated.

Vintage is in the favourable position of having a direct line of site to cash flow generation through the production and sale of gas within two years of listing on the ASX. Not many companies could claim such early stage success. The Board considers that the potential to generate revenue should be pursued by all available means, as this will allow the Company to self-fund future capital works and deliver material and sustainable growth to its shareholders.

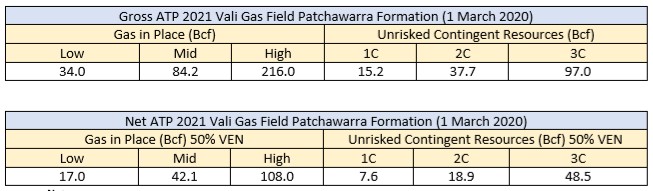

The recent 2C Contingent Resources for the Vali gas discovery, independently certified by ERCE, are detailed in the table below.

Notes